Property Tax Calculator Beaumont . This is equal to the median property tax paid as a percentage of the. *properties annexed from leduc county will use the. Compare your rate to the california and u.s. in our calculator, we take your home value and multiply that by your county's effective property tax rate. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. calculate property tax for beaumont with your home's assessed value. Assessment is the process of assigning a dollar value to a property for tax purposes. Most annual property taxes include a computation based on a percentage of. Calculate property taxes including california property taxes. Tax rates for property assessments change annually. navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your.

from wealthfit.com

This is equal to the median property tax paid as a percentage of the. calculate property tax for beaumont with your home's assessed value. navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your. in our calculator, we take your home value and multiply that by your county's effective property tax rate. Tax rates for property assessments change annually. Compare your rate to the california and u.s. *properties annexed from leduc county will use the. Calculate property taxes including california property taxes. Assessment is the process of assigning a dollar value to a property for tax purposes. calculate how much you'll pay in property taxes on your home, given your location and assessed home value.

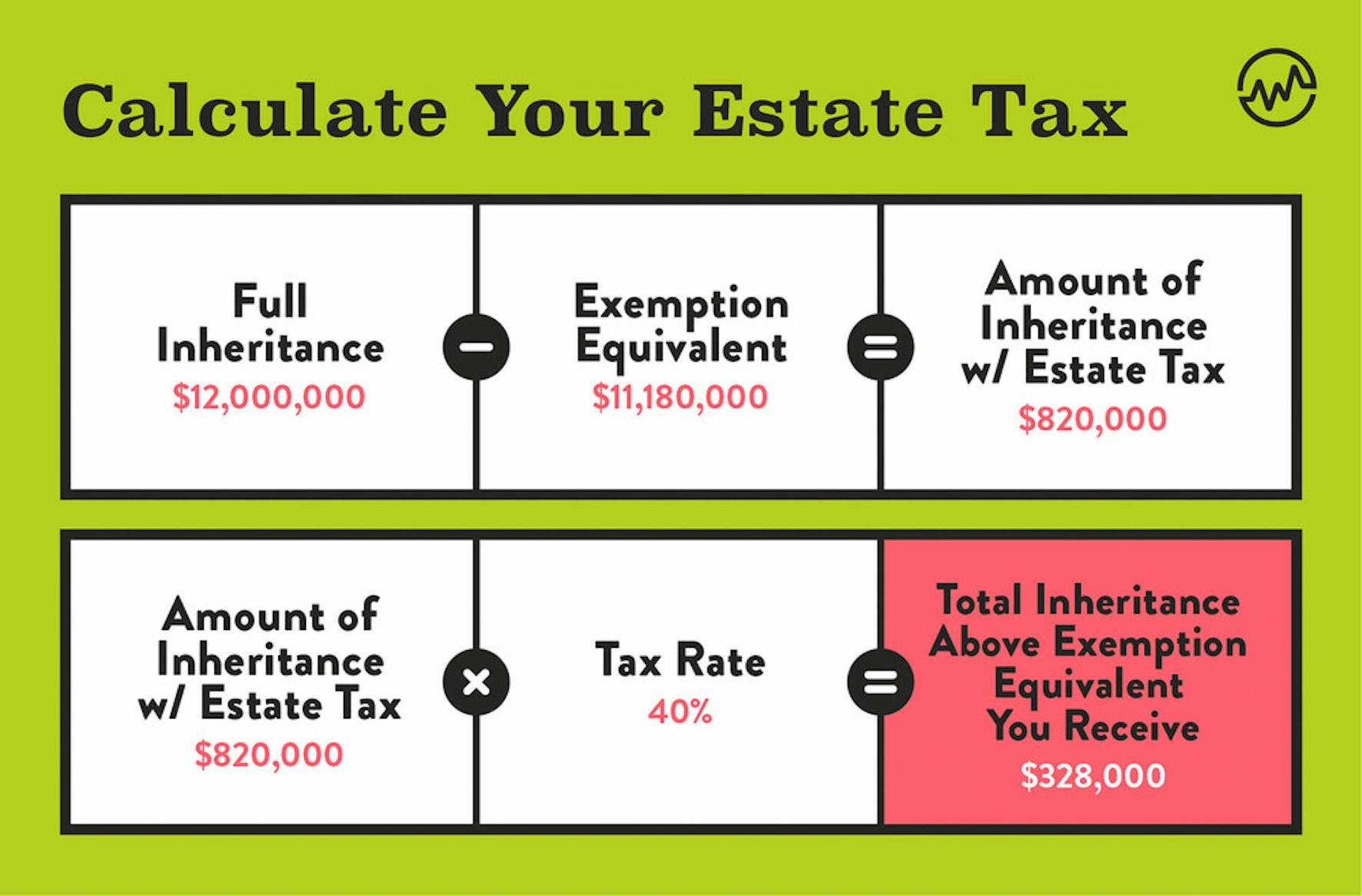

Inheritance Tax How Much Will Your Children Get? Your Estate Tax WealthFit

Property Tax Calculator Beaumont in our calculator, we take your home value and multiply that by your county's effective property tax rate. Most annual property taxes include a computation based on a percentage of. navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your. Calculate property taxes including california property taxes. in our calculator, we take your home value and multiply that by your county's effective property tax rate. This is equal to the median property tax paid as a percentage of the. Compare your rate to the california and u.s. Tax rates for property assessments change annually. Assessment is the process of assigning a dollar value to a property for tax purposes. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. *properties annexed from leduc county will use the. calculate property tax for beaumont with your home's assessed value.

From www.stlouis-mo.gov

How to Calculate Property Taxes Property Tax Calculator Beaumont navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your. Assessment is the process of assigning a dollar value to a property for tax purposes. This is equal to the median property tax paid as a percentage of the. Calculate property taxes including california property taxes. Compare your rate to. Property Tax Calculator Beaumont.

From de.slideshare.net

Use Online Property Tax Calculator for Estimating Value of Property T… Property Tax Calculator Beaumont calculate how much you'll pay in property taxes on your home, given your location and assessed home value. *properties annexed from leduc county will use the. Most annual property taxes include a computation based on a percentage of. calculate property tax for beaumont with your home's assessed value. in our calculator, we take your home value and. Property Tax Calculator Beaumont.

From idreesdenver.blogspot.com

Property tax calculator IdreesDenver Property Tax Calculator Beaumont navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your. This is equal to the median property tax paid as a percentage of the. *properties annexed from leduc county will use the. calculate how much you'll pay in property taxes on your home, given your location and assessed home. Property Tax Calculator Beaumont.

From www.paramountpropertytaxappeal.com

Harris County Property Tax site Property Tax Calculator Beaumont calculate property tax for beaumont with your home's assessed value. in our calculator, we take your home value and multiply that by your county's effective property tax rate. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Tax rates for property assessments change annually. Calculate property taxes including. Property Tax Calculator Beaumont.

From cenddgpf.blob.core.windows.net

Kings County Ny Property Tax Calculator at Stacey Saenz blog Property Tax Calculator Beaumont navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your. Most annual property taxes include a computation based on a percentage of. Calculate property taxes including california property taxes. This is equal to the median property tax paid as a percentage of the. Assessment is the process of assigning a. Property Tax Calculator Beaumont.

From www.pinterest.com

Trying to figure out how to calculate your Commercial Property Tax? Property tax, Tax Property Tax Calculator Beaumont Calculate property taxes including california property taxes. calculate property tax for beaumont with your home's assessed value. Assessment is the process of assigning a dollar value to a property for tax purposes. in our calculator, we take your home value and multiply that by your county's effective property tax rate. navigate the stax property finder application tool. Property Tax Calculator Beaumont.

From www.ciret-avt.com

What’s Property Tax Calculator? Ciret Real Estate Property Tax Calculator Beaumont This is equal to the median property tax paid as a percentage of the. calculate property tax for beaumont with your home's assessed value. Tax rates for property assessments change annually. Assessment is the process of assigning a dollar value to a property for tax purposes. calculate how much you'll pay in property taxes on your home, given. Property Tax Calculator Beaumont.

From issuu.com

2022 Property Tax Guide by BeaumontAlberta Issuu Property Tax Calculator Beaumont Tax rates for property assessments change annually. Most annual property taxes include a computation based on a percentage of. *properties annexed from leduc county will use the. Calculate property taxes including california property taxes. navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your. Assessment is the process of assigning. Property Tax Calculator Beaumont.

From www.youtube.com

How Your Property Tax is Calculated YouTube Property Tax Calculator Beaumont Most annual property taxes include a computation based on a percentage of. Tax rates for property assessments change annually. This is equal to the median property tax paid as a percentage of the. Calculate property taxes including california property taxes. navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your.. Property Tax Calculator Beaumont.

From www.apnaplan.com

Capital Gains Calculator For Property 2021 ★ Know Your Tax Liability ★ Personal Property Tax Calculator Beaumont Most annual property taxes include a computation based on a percentage of. This is equal to the median property tax paid as a percentage of the. Tax rates for property assessments change annually. navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your. *properties annexed from leduc county will use. Property Tax Calculator Beaumont.

From setting.ae

Understanding the Mysore Property Tax Calculator A Guide for Property Owners Property Tax Calculator Beaumont Compare your rate to the california and u.s. navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your. calculate property tax for beaumont with your home's assessed value. This is equal to the median property tax paid as a percentage of the. Assessment is the process of assigning a. Property Tax Calculator Beaumont.

From www.etsy.com

The Landlord Calculator Excel Spreadsheet Rental Property Investment Analysis and Calculator Etsy Property Tax Calculator Beaumont This is equal to the median property tax paid as a percentage of the. *properties annexed from leduc county will use the. in our calculator, we take your home value and multiply that by your county's effective property tax rate. calculate property tax for beaumont with your home's assessed value. Assessment is the process of assigning a dollar. Property Tax Calculator Beaumont.

From www.homebazaar.com

BBMP Property Tax 2024 Online Payment Process and Property Tax Calculator Property Tax Calculator Beaumont This is equal to the median property tax paid as a percentage of the. Tax rates for property assessments change annually. in our calculator, we take your home value and multiply that by your county's effective property tax rate. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Calculate. Property Tax Calculator Beaumont.

From hafidhandris.blogspot.com

34+ property tax proration calculator Hafidhandris Property Tax Calculator Beaumont calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Calculate property taxes including california property taxes. This is equal to the median property tax paid as a percentage of the. Tax rates for property assessments change annually. in our calculator, we take your home value and multiply that by. Property Tax Calculator Beaumont.

From fnrpusa.com

How to Estimate Commercial Real Estate Property Taxes FNRP Property Tax Calculator Beaumont navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your. Calculate property taxes including california property taxes. This is equal to the median property tax paid as a percentage of the. Tax rates for property assessments change annually. Most annual property taxes include a computation based on a percentage of.. Property Tax Calculator Beaumont.

From www.ownerly.com

How to Calculate Property Tax Ownerly Property Tax Calculator Beaumont Compare your rate to the california and u.s. navigate the stax property finder application tool using your property address or parcel identification number (pin) found on your. calculate property tax for beaumont with your home's assessed value. Tax rates for property assessments change annually. Most annual property taxes include a computation based on a percentage of. calculate. Property Tax Calculator Beaumont.

From www.youtube.com

How to Calculate Property Taxes Ask the Instructor YouTube Property Tax Calculator Beaumont Compare your rate to the california and u.s. Calculate property taxes including california property taxes. Tax rates for property assessments change annually. *properties annexed from leduc county will use the. Most annual property taxes include a computation based on a percentage of. calculate property tax for beaumont with your home's assessed value. Assessment is the process of assigning a. Property Tax Calculator Beaumont.

From calculatoradam.com

Property Tax Calculator by Zip Code [2024] Calculator Adam Property Tax Calculator Beaumont Compare your rate to the california and u.s. Most annual property taxes include a computation based on a percentage of. in our calculator, we take your home value and multiply that by your county's effective property tax rate. Assessment is the process of assigning a dollar value to a property for tax purposes. Calculate property taxes including california property. Property Tax Calculator Beaumont.